Tax on ultra-processed, sugary drinks

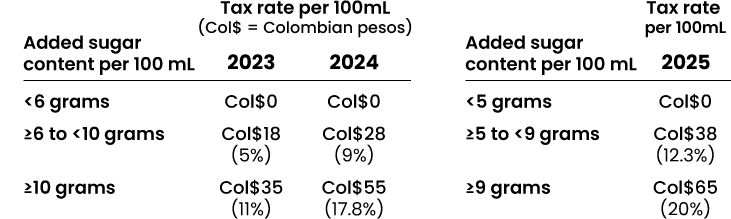

Beginning November 1, 2023, Colombia will tax all ultra-processed sugary drinks, including carbonated and non-carbonated beverages, malt-based beverages, teas, coffee-type beverages, fruit drinks and nectars, fruit concentrates, energy drinks, sports drinks, flavored waters, and powder mixes. The following beverages are exempt: plain water, 100% fruit or vegetable juices, and infant formula. The tax rate will depend on beverages’ added sugar content and will increase yearly in three phases (with more strict sugar thresholds in 2025), and will be updated for inflation automatically, starting in 2026.

Tax on ultra-processed food products

Beginning November 1, 2023, Colombia will tax ultra-processed foods, defined as edible products formulated from food-derived substances along with additives, that contain added sugars, sodium, and saturated fats and exceed the following thresholds for those nutrients:

- >1 mg of sodium per 1 kcal and/or >300 mg of sodium per 100 g

- >10% of total energy from free sugars

- >10% of total energy form saturated fats

The tax rates will be 10% in 2023, 15% in 2024 and 20% in 2025.

Ultra-processed food categories subject to taxation will include: milk products added with sugar, sausages and cold cut meats, chocolates and confectionary candies, snacks, bakery products, breakfast cereals, canned fruits and vegetables added with fat, sugar or salt, jams, jellies and marmalades, sauces, condiments, and seasonings. Exempt categories are Colombian traditional foods such as arequipe or dulce de leche (milk caramel), salchichon (sausage), oblea (thin round wafer), bocadillo (guava paste).

Read law in Spanish | English (translation of Title V: Health Taxes).