Promoting healthier purchases: ultra-processed food taxes and minimally-processed food subsidies for the low income.

Authors: Pourya Valizadeh, Shu Wen Ng

Published in: American Journal of Preventative Medicine, April 2, 2024 view full text

Impact of the Philadelphia beverage tax on perceived beverage healthfulness, tax awareness and tax opinions

Authors: Caitlin Lowery, Christina Roberto, Sophia Hua, Sara Bleich, Nandita Mitra, Hannah Lawman, Lindsey Smith Taillie, Shu Wen Ng, Laura Gibson

Published in: Journal of Nutrition Education and Behavior, March 9, 2024 view full text

Understanding Whether Price Tag Messaging Can Amplify the Benefits of Taxes: An Online Experiment.

Authors: Marissa Hall, Phoebe Ruggles, Katherine McNeel, Carmen Prestemon, Cristina Lee, Caitlin Lowery, Aline D'Angelo Campos, Lindsey Smith Taillie

Published In: American Journal Of Preventative Medicine, January 7, 2024 view full text

Cost-benefit analysis of alternative tax policies on sugar-sweetened beverages in Mexico

Authors: Juan Carlos Salgado Hernandez, Shu Wen Ng, Sally C. Stearns, Justin G. Trogdon

Published in: PLOS One, October 3, 2023 view full text

Impact of taxes and warning labels on red meat purchases in a naturalistic online grocery store: A randomized controlled trial

Authors: Lindsey Smith Taillie, Maxime Bercholz, Carmen Prestemon, Isabella Higgins, Anna H. Grummon, Marissa G. Hall, Lindsay Jaacks

Published in: PLOS Medicine, September 18, 2023

view full text

Changes in sugar-sweetened beverage purchases across the price distribution after the implementation of a tax in Mexico: a before-and-after analysis

Authors: Juan Carlos Salgado Hernández, Shu Wen Ng, M. Arantxa Colchero

Published in: BMC Public Health, February 7, 2023 view full text

Employment and wage effects of sugar-sweetened beverage taxes and front-of-package warning label regulations on the food and beverage industry: Evidence from Peru

Authors: Juan-José Díaz, Alan Sánchez, Francisco Diez-Canseco, J. Jaime Miranda, Barry

M. Popkin

Published in: Food Policy, January 20, 2023 view full text

Sugar-sweetened beverage purchases in urban Peru before the implementation of taxation and warning label policies: a baseline study

Authors: Caitlin M. Lowery, Lorena Saavedra-Garcia, Francisco Diez-Canseco, María Kathia Cárdenas, J. Jaime Miranda, Lindsey Smith Taillie

Published in: BMC Public Health, December 20, 2022 view full text

Grocery purchase changes were associated with a North Carolina COVID food assistance incentive program

Authors: Caitlin M. Lowery, Richard Henderson, Neal Curran, Sam Hoeffler, Molly DeMarco, Shu Wen Ng

Published in: Health Affairs, November 7, 2022 view full text

Are intentions to change, policy awareness, or health knowledge related to changes in dietary intake following a sugar-sweetened beverage tax in South Africa? A before-and-after study

Authors: Michael Essman, Catherine Zimmer, Francesca Dillman Carpentier, Elizabeth C. Swart, Lindsey Smith Taillie

Published in: International Journal of Behavioral Nutrition and Physical Activity, October 28, 2022 view full text

Simulation models of sugary drink policies: A scoping review

Authors: Natalie Riva Smith, Anna H. Grummon, Shu Wen Ng, Sarah Towner Wright, Leah Frerichs

Published in: PLOS ONE, October 3, 2022 view full text

Decomposing consumer and producer effects on sugar from beverage purchases after a sugar-based tax on beverages in South Africa

Authors: Maxime Bercholz, Shu Wen Ng, Nicholas Stacey, Elizabeth C. Swart

Published in: Economics & Human Biology, March 21, 2022 view full text

South Africa’s Health Promotion Levy on pricing and acquisition of beverages in local spazas and supermarkets

Authors: Alexandra Ross, Elizabeth C. Swart, Tamryn Frank, Caitlin M. Lowery, Shu Wen Ng

Published in: Public Health Nutrition, March 7, 2022 view full text

Purchases of non-taxed foods, beverages, and alcohol in a longitudinal cohort after implementation of the Philadelphia Beverage Tax

Authors: Anna H. Grummon, Christina A. Roberto, Hannah G. Lawman, Sara N. Bleich, Jiali Yan, Nandita Mitra, Sophia V. Hua, Caitlin M. Lowery, Ana Peterhans, Laura A. Gibson

Published in: The Journal of Nutrition, December 15, 2021 view full text

The impacts on food purchases and tax revenues of a tax based on Chile’s nutrient profiling model

Authors: M. Arantxa Colchero, Guillermo Paraje, Barry M. Popkin

Published in: PLOS ONE, December 2, 2021 view full text

Examining the news media reaction to a national sugary beverage tax in South Africa: A quantitative content analysis

Authors: Michael Essman, Fernanda Mediano Stoltze, Francesca Dillman Carpentier, Elizabeth C. Swart, Lindsey Smith Taillie

Published in: BMC Public Health, December 2021 view full text

How should we evaluate sweetened beverage tax policies? A review of worldwide experience

Authors: Shu Wen Ng, M. Arantxa Colchero, Martin White

Published in: BMC Public Health, October 26, 2021 view full text

Cash transfer programs are important for improved nutrition in low- and middle-income countries

Authors: Barry M. Popkin

Published in: The Journal of Nutrition, October 12, 2021 view full text

Linking a sugar-sweetened beverage tax with fruit and vegetable subsidies: A simulation analysis of the impact on the poor

Authors: Pourya Valizadeh, Barry M. Popkin, Shu Wen Ng

Published in: The American Journal of Clinical Nutrition, October 5, 2021 view full text

Simulating international tax designs on sugar-sweetened beverages in Mexico

Authors: Juan Carlos Salgado Hernández, Shu Wen Ng

Published in: PLOS ONE, August 19, 2021 view full text

South Africa's health promotion levy: Excise tax findings and equity potential

Authors: Karen Hofman, Nicholas Stacey, Elizabeth Swart, Barry Popkin, Shu Wen Ng

Published in: Obesity Reviews, May 31, 2021 view full text

Taxed and untaxed beverage consumption by young adults in Langa, South Africa before and one year after a national sugar-sweetened beverage tax

Authors: Michael Essman, Lindsey Smith Taillie, Tamryn Frank, Shu Wen Ng, Barry M. Popkin, Elizabeth C. Swart

Published in: PLOS Medicine, May 25, 2021 view full text

Changes in beverage purchases following the announcement and implementation of South Africa's Health Promotion Levy: An observational study

Authors: Nicholas Stacey, Ijeoma Edoka, Karen Hofman, Elizabeth C. Swart, Barry Popkin, and Shu Wen Ng

Published in: The Lancet Planetary Health, April 1, 2021 view full text

Sugar-sweetened beverage reduction policies: Progress and promise

Authors: James Krieger, Sara Bleich, Stephanie Scarmo, and Shu Wen Ng

Published in: Annual Review of Public Health, April 1, 2021 view full text

Would a national sugar‐sweetened beverage tax in the united states be well targeted?

Authors: Pourya Valizadeh, Shu Wen Ng

Published in: American Journal of Agricultural Economics, February 2, 2021 view full text

Implementation science is important for understanding and advancing beverage taxes

Authors: Sara N. Bleich, Jamie Chriqui, Shu Wen Ng

Published in: Am J Public Health, September 1, 2020 view full text

Mexican households’ food shopping patterns in 2015: Analysis following nonessential food and sugary beverage taxes

Authors: Lilia S Pedraza, Barry M Popkin, Linda Adair, Whitney R Robinson, Lindsey Smith Taillie

Published in: Public Health Nutrition, August 5, 2020 view full text

Association between tax on sugar sweetened beverages and soft drink consumption in adults in Mexico: Open cohort longitudinal analysis of Health Workers Cohort Study

Authors: Luz María Sánchez-Romero, Francisco Canto-Osorio, Romina González-Morales, M Arantxa Colchero, Shu Wen Ng, Paula Ramírez-Palacios, Jorge Salmerón, Tonatiuh Barrientos-Gutiérrez

Published in: BMJ, May 6, 2020 view full text

Body weight impact of the sugar-sweetened beverages tax in Mexican children: A modeling study

Authors: Rossana Torres-Álvarez, Rodrigo Barrán-Zubaran, Francisco Canto-Osorio, Luz M. Sánchez-Romero, Dalia Camacho-García-Formentí, Barry M. Popkin, Juan A. Rivera, Rafael Meza, Tonatiuh Barrientos-Gutiérrez

Published in: Pediatr Obes, April 13 2020 view full text

Combined fiscal policies to promote healthier diets: effects on purchases and consumer welfare

Authors: Juan C. Caro, Pourya Valizadeh, Alejandrina Correa, Andres Silva, Shu Wen Ng

Published in: PLOS One, January 15 2020 view full text

Understanding heterogeneity in price changes and firm responses to a national unhealthy food tax in Mexico

Authors: Juan C. Salgado, Shu Wen Ng

Published in: Food Policy, December 1 2019 view full text

The caloric and sugar content of beverages purchased at different store-types changed after the sugary drinks taxation in Mexico

Authors: Lilia S. Pedraza, Barry M. Popkin, Carolina Batis, Linda Adair, Whitney R. Robinson, David K. Guilkey, Lindsey S. Taillie

Published in: Int J Behav Nutr Phys Act, November 12 2019 view full text

Sugar-based beverage taxes and beverage prices: Evidence from South Africa’s Health Promotion Levy

Authors: Nicholas Stacey, Caroline Mudara, Shu Wen Ng, Corne van Walbeek, Karen Hofman, Ijeoma Edoka

Published in: Social Science & Medicine, October 1 2019 view full text

Did high sugar-sweetened beverage purchasers respond differently to the excise tax on sugar-sweetened beverages in Mexico?

Authors: Shu Wen Ng, Juan A. Rivera, Barry M. Popkin, Michelle A. Colchero

Published in: Public Health Nutr, March 2019 view full text

Patterns and trends in the intake distribution of manufactured and homemade sugar-sweetened beverages in pre-tax Mexico, 1999-2012

Authors: Tania Aburto, Jennifer M. Poti, Barry M. Popkin

Published in: Public Health Nutr, December 2018 view full text

Chile’s 2014 sugar-sweetened beverage tax and changes in prices and purchases of sugar-sweetened beverages: An observational study in an urban environment

Authors: Juan C. Caro, Camila Corvalán, Marcela Reyes, Andres Silva, Barry M. Popkin, Lindsey S. Taillie

Published in: PLOS Med, 2018 view full text

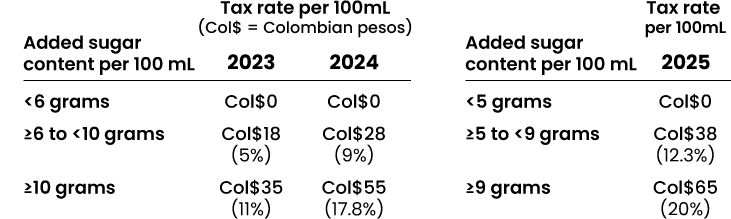

Sugary drinks taxation, projected consumption and fiscal revenues in Colombia: Evidence from a QUAIDS model

Authors: Juan C. Caro, Shu Wen Ng, Ricardo Bonilla, Jorge Tovar, Barry M. Popkin

Published in: PLOS ONE, December 20 2017 view full text view full text

Mexican cohort study predates but predicts the type of body composition changes expected from the Mexican sugar-sweetened beverage tax

Author: Barry M. Popkin

Published in: Am J Public Health, November 2017 view full text

Designing a tax to discourage unhealthy food and beverage purchases: The case of Chile

Authors: Juan C. Caro, Shu Wen Ng, Lindsey S. Taillie, Barry M. Popkin

Published in: Food Policy, August 2017 view full text

Do high vs. low purchasers respond differently to a nonessential energy-dense food tax? Two-year evaluation of Mexico’s 8% nonessential food tax

Authors: Lindsey S. Taillie, Juan A. Rivera, Barry M. Popkin, Carolina Batis

Published in: Preventive Medicine, July 17 2017 view full text

Sugar-sweetened beverage tax: The authors reply

Authors: Michelle A. Colchero, Shu Wen Ng, Barry M. Popkin

Published in: Health Aff (Millwood), June 2017 view full text

Changes in prices, sales, consumer spending and beverage consumption one year after a tax on sugar-sweetened beverages in Berkeley, USA: A before-and-after study

Authors: Lynn D. Silver, Shu Wen Ng, Suzanne Ryan-Ibarra, Marta Induni, Donna R. Miles, Jennifer M. Poti, Lindsey S. Taillie, Barry M. Popkin

Published in: PLoS Medicine, April 2017, See video overview view full text

In Mexico, evidence of sustained consumer response two years after implementing a sugar-sweetened beverage tax

Authors: Michelle A. Colchero, Barry M. Popkin, Juan A. Rivera, Shu Wen Ng

Published in: Health Affairs, March 2017 view full text

SSB taxes and diet quality in U.S. preschoolers: Estimated changes in the 2010 Healthy Eating Index

Authors: Christopher N. Ford, Jennifer M. Poti, Shu Wen Ng, Barry M. Popkin

Published in: Pediatric Obesity, April 5 2016 view full text

Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study

Authors: M Arantxa Colchero, Barry M. Popkin, Juan A. Rivera, Shu Wen Ng

Published in: BMJ, January 2016 view full text

Changes in prices after an excise tax to sugar sweetened beverages was implemented in Mexico: evidence from urban areas

Authors: Colchero MA, Salgado JC, Unar-Munguía M, Molina M, Ng SW, Rivera-Dommarco JA

Published in: PLoS ONE, December 2015 view full text

Targeted beverage taxes influence food and beverage purchases among households with preschool children

Authors: Christopher N. Ford, Shu Wen Ng, Barry M. Popkin

Published in: Journal of Nutrition, August 2015 view full text

Drinking to our health: Can beverage companies cut calories while maintaining profits?

Authors: Susan Kleiman, Shu Wen Ng, Barry M. Popkin

Published in: Obesity Reviews, March 2012 view full text